Apr 28 2009

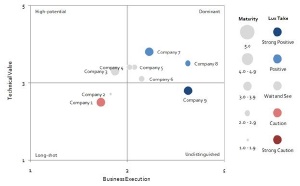

Emerging technologies offer breakthrough investment and business opportunities. Unfortunately, identifying winners is challenging because these nascent fields are populated by an abundance of unproven start-ups, established companies, and international players - all fielding diverse business plans and unfamiliar technologies. A new tool from Lux Research, the Lux Innovation Grid, provides a standard reference for evaluating companies active in emerging technologies, based on the proprietary insights of Lux Research's highly-regarded analyst team.

"The Lux Innovation Grid builds on Lux Research's ongoing scouting of emerging technology markets," said Michael Holman, Research Director at Lux Research. "This framework gives our clients a more incisive tool to cut through the fog and quickly arrive at better decisions - whether they're corporations looking for partners or M&A targets, financiers identifying early market leaders, or start-ups seeking insight into the competition they face."

The Lux Innovation Grid provides a visually intuitive snapshot of individual companies in a given technology area, based on three criteria - the strength and value of their core technology, their business execution, and their maturity - as well as Lux Research's own "Lux Take." The scoring is based on factual information collected in primary interviews and site visits, in addition to Lux Research analysts' independent evaluation of the company on 10 different factors, as well as Lux's market insights in each technology domain. For more details on the Lux Innovation Grid, see www.luxresearchinc.com/lig.

Source: Lux Research

Start-ups lead the way from the nanomaterials lab to market

The new framework makes its debut in Lux Research's latest report - entitled "Grading Nanomaterial Start-ups on the Lux Innovation Grid" - which takes stock of the landscape of start-ups supplying six types of nanomaterials: ceramic nanoparticles, nanoporous materials, carbon nanotubes, metal nanoparticles, quantum dots, and graphene. The report is based on information gathered during more than 300 interviews over the last two years with executives of companies working in the space. Among its key findings:

- Heavyweights will enter the nanoporous materials space. With the success of Aspen Aerogels and NanoPore seemingly unchecked, the nanoporous material space looks primed for entry of large corporations like BASF.

- Many ceramic nanoparticle producers will fail, or be bought on the cheap. While a few ceramic nanoparticle producers, like NanoScale, are well-positioned to weather the downturn, many will fall into financially weak positions by the end of the year. Those with valuable technologies or patent portfolios will get picked up by corporations with shared interests and complementary skills.

- Carbon nanotube suppliers will experience a shakeout. The difficulty of securing financing and encroachment from large corporations will push many multi-walled nanotube suppliers over the edge. Single-walled nanotube suppliers are more insulated from corporate competition, but their target markets remain immature and sales have been minimal; once cash reserves run out, these suppliers will share a similar fate.

"By positioning nanomaterials companies on the Lux Innovation Grid, this report helps clients spot potential opportunities, including partnerships, mergers and acquisitions, technology licensing plays, and investments - as well as competitive threats," said David Hwang, a Research Associate at Lux Research and the report's lead author. "Whatever their goals, this tool can help them make sense of a complex technology landscape and better meet their business objectives."

"Grading Nanomaterial Start-ups on the Lux Innovation Grid" is part of the Lux Nanomaterials Intelligence service. Clients of this service receive: 1) regular State of the Market reports; 2) ongoing technology scouting reports and proprietary data points in the weekly Lux Research Nanomaterials Journal; and 3) on-demand inquiry with Lux Research analysts.