Mar 27 2009

The challenge with all emerging liabilities is to identify risk potentialities at an early stage, and well before they become the subject of court action.

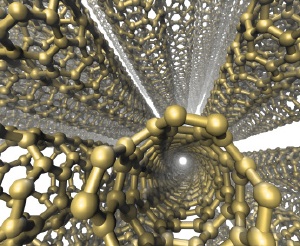

Nanotechnologies manipulate materials by breaking them down into an 'unimaginably small scale'.

Nanotechnologies manipulate materials by breaking them down into an 'unimaginably small scale'.

Technology is no exception and with rapid innovation companies can find it difficult to keep up with the risks.

Nanotechnology is a good example.

And it's one where you get a sense that the complexity of the technology involved combined with the potential for media hype could make a dangerous cocktail.

On the radar

Certainly, board-level executives have technology on their mind.

When Lloyd’s and the Economist Intelligence Unit polled global CEOs about which emerging liabilities they thought may become tomorrow’s biggest headaches, technology came among the top of their list, alongside environmental liability and corporate governance worries.

Real or perceived risk

Nanotechnologies manipulate materials by breaking them down into an ‘unimaginably small scale’, with nano referring to a millionth of a millimetre.

The technologies create opportunities to achieve increasingly powerful products, from computer chips to suntan lotion, by working at particle levels.

Three areas where nanotechnologies are currently being used are personal care, hygiene and cleaning systems and products, and food and nutrition.

It’s important to try and distinguish between the real and perceived risks associated with nanotechnology, says Joe Raguso, CEO of Intrinsiq Materials Ltd, an advanced materials company.

Lloyd's examining potential threats

Over the past 18 months, the Lloyd’s Emerging Risks team has been examining the potential threats associated with nanotechnology from an insurance perspective, so it’s interesting to hear the views of a CEO whose business actually uses the technology.

In 2006, nanoparticles were reported to be behind the breathing difficulties that a bathroom sealant caused in some consumers in Germany. It was subsequently suggested that the product didn’t contain any nanoparticles after all.

Then, last year, a study suggesting that carbon nanotubes could behave like asbestos was widely reported and some news articles drew a link between nanotechnology and cancer.

Hazard and exposure risks

“There are real hazard and exposure risks associated with nanotechnology,” Raguso says, “But we cannot look at nanotechnology as one class of materials”.

The evidence so far suggests that different nano materials can be either more or less toxic than their equivalent materials in bulk, Raguso believes. In a best case scenario “nanotechnology could prove to be more dangerous than ordinary substances in only a handful of cases”, he says.

Insurer concerns

Like others in the insurance industry, Lloyd’s is alert to the potential for nano products to be associated with health and safety risks, whether real or perceived.

For those businesses involved in their development and manufacture, there is the particular risk of becoming the target of future litigation from a range of sources, from employees and customers to the state.

Fears of a compensation culture creeping from the US to Europe and Asia only heighten these concerns and spread the net of potential liability even further.

Research and regulation

Research and regulation are the two critical tools which can help society and its insurers to better understand and manage the potential risks, Lloyd’s believes.

Research should be better co-ordinated, both at a national and an international level, while the many diverse applications of nanotechnology need a coherent regulatory framework.

Both of these are challenges that industry and government need to work on together, and the insurance industry can play a valuable part in this work.

A fine balance

Nanotechnology has unquestionable potential to bring huge benefits for society and for business too.

In today’s economic climate, it seems that one of the few realistic routes to growth is innovation. Those companies which are able to exploit nanotechnology will be well placed to succeed.

At the same time, when you think that part of the reason behind the turmoil in our financial markets was the blithe acceptance of complex products that many didn’t understand, the importance of getting to grips with and quantifying complex sources of risk has never been more obvious.